There is no secret recipe for grief after losing a loved one. Only time will gradually ease the pain.

In the following section, we concentrate on supporting you in the first formalities that need to be made and providing you with the necessary information along the way.

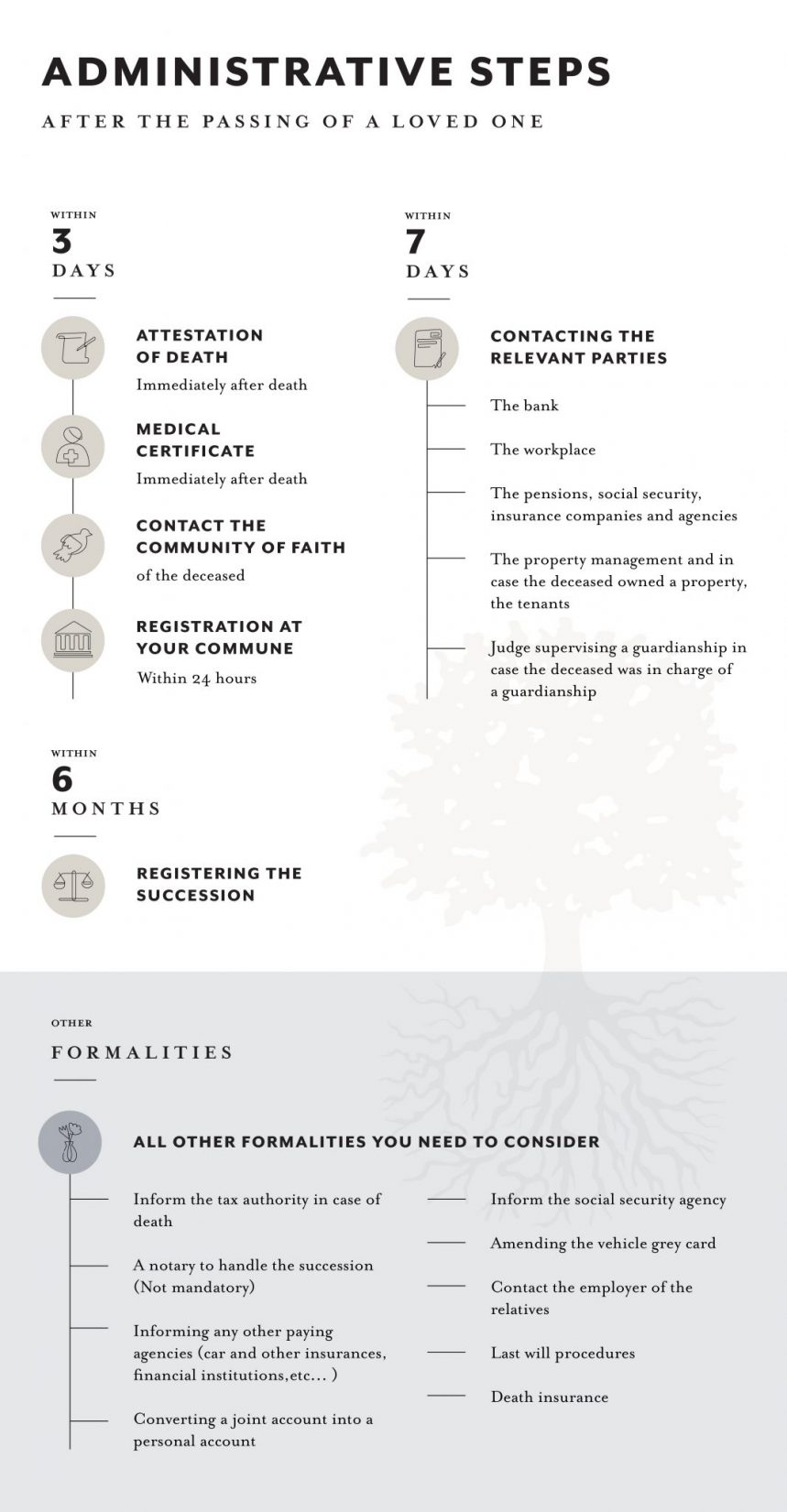

In our guide you will find most answers to questions that you will certainly ask yourself in the event of death of a relative or loved one. Some actions are urgent and must be taken care of within the first 24 hours or during the first week following the event of death. Others allow for more time and have to be finalized within 30 days or within the first 6 months. Instructions regarding a will or a life insurance policy are also provided in our guide. The relevant legal texts provide you with all the main details.

THE FIRST FORMALITIES

A doctor issues the attestation of death immediately after and where the death has occurred.

- If death occurs at home, death is pronounced and an attestation of death is issued by a physician.

- If death occurs in hospital or in a retirement or nursing home, the attestation of death will be passed on to the institution’s registration service.

- If death occurs on a public road or in a public area, or in conditions requiring emergency services the attestation of death is issued by the doctor in charge.

Accidental deaths and suicides, deaths where the cause is unknown, violent, suspicious deaths and deaths caused by an act of crime are subject to an investigation by a Coroner’s Officer.

Consequences regarding the deceased:

- Possible transfer of the body to a forensic institute for an autopsy subject to Coroner’s decision

- Issuance of the death certificate by a physician appointed by the Coroner

- Issuance of an authorisation for burial by the Coroner (deputy public prosecutor).

The doctor will issue the medical certificate immediately after death has occurred.

The certificate confirms that the death is free from any forensic complications and that the deceased is not affected by any WHO-listed contagious diseases.

In case of cremation the doctor must specify that the deceased is not carrying a battery-powered device (pacemaker, heart pump, etc.). It should be stressed that it is illegal to dispose of, keep or scatter the ashes in places not officially sanctioned or recognised for that purpose.

The certificate is necessary and mandatory for:

- Transport of the body of the deceased to another commune,

- Transport abroad of the body after it has been placed in a coffin,

- embalming,

- cremation.

A death must be registered at the registry office of the commune where the death has occurred within 24 hours (working days). The death can be registered by a next of kin or any other person able to present a valid piece of identification or by the funeral directors tasked with the registration.

Documents required for registration:

- the attestation of death as issued by the doctor who pronounced the death; the medical certificate as stipulated in Article 8 Paragraph 1 of the Grand-Ducal decree dated 14th February 1913.

- The family record book of the deceased, or, failing that, another document establishing the identity of the deceased (copy of the birth certificate etc.), their parentage, marital status at time of death, address and profession (for minors: parents’ profession)

- For foreign residents: residence card, identity card etc.,

- In case of cremation registration also requires the ‘no cardiac device’-certificate and an authorisation for cremation request signed by the spouse of the deceased or, if the deceased was not married, by their next of kin.

While at the registry office you may want to request:

- Six copies of the death certificate for upcoming administrative arrangements,

- An authorisation for burial request (for interment),

- If required: an authorisation for transport, an authorisation for cremation and a funeral report form ‘bulletin d’enterrement’ (funeral certificate)

A person’s death must be reported to the local authorities’ registry office.

It is highly recommended to also declare the death at the consulate representing the country of origin of the deceased. If that is not possible, the death can be recorded in the consular civil status register. In both cases (declaration or registration), the death will be registered in the birth records of the country of origin of the deceased.

If no family member is present in the country where the death has occurred the consulate will contact the family of the deceased to check if their insurance policy covers the return of the body of the deceased from abroad and to enquire if the family prefers repatriation of the body or repatriation of the cremated remains. The consulate then initiates the repatriation procedure.

The fees incurred for the return of the body or ashes, or for interment abroad are borne by the family.

For more information in Luxembourg

Ministère des Affaires Etrangères, du Commerce Extérieur, de la Coopération, de l’Action Humanitaire et de la Défense

5, rue Notre-Dame | L-2240 Luxembourg

Tél.: + 352 478-1 | Fax : + 352 22 31 44

Abroad

The closest embassy or consulate.

The bereaved are required to contact the religious community of the deceased with a view to organising the funeral service.

Luxembourg Archdiocese

Rectory or local priest (place of residence of the deceased)

Mosque

Synagogue

Protestant Temple

Orthodox Church

INBETWEEN THE 7 DAYS

The spouse or family members of the deceased must visit any banks where the deceased was holder or joint holder of one or more bank accounts.

The following documents must be presented to the bank representative:

- The death certificate

- A certificate of inheritance (certificat de notoriété)

- Means of payment: debit and credit cards belonging to the deceased,

- If available the original copy of the life insurance policy contract

Once a bank has been informed that one of its clients has passed away it is required to take a number of measures. It generally freezes the relevant bank account(s) (except joint accounts) and, if necessary, bans access to the safe of the deceased until the certificate of devolution of the estate (‘acte de dévolution successorale’), i.e. the document indicating how the estate of the deceased is to be distributed, can be presented (deed of succession).

The funeral can however be paid for using money held in the account of the deceased. (Not all banks allow that.) Any unpaid bills remain valid and any proxy agreements expire in the event of a death.

The death of an employee grants the heirs of the deceased a number of rights as regards the employer:

- Death of an employee: the employer is required to pay an allowance to a certain category of inheritors

The beneficiaries are:

- The surviving spouse not living separate and apart from the deceased based on the provisions of a final and conclusive judgment, otherwise;

- Minor children and children of age of the deceased employee whose support and maintenance they were responsible for, otherwise;

- Relatives in the ascending line the deceased employee was living with, provided the deceased was responsible for the maintenance of said relatives.

The beneficiaries are entitled to an allowance the equivalent of the salary for the month in which the death occurred and three monthly salaries of the deceased. If the deceased employee enjoyed free official lodgings the employer is obliged to put said lodgings at the following expired the death of the employee has expired (Labour Code Article L.125-1-).

Labour courts are not competent for appeals lodged by inheritors. Competence lies with the ordinary courts.

Once they have been informed of the death of the employee employers are required to hand those entitled:

- Any outstanding payments,

- Paid leave,

- Salary reports,

- Certificate of attendance.

The competent authorities will use these documents to calculate any allowances and as a basis for transfer of death benefits.

If the deceased was employed the widow or widower might be entitled to additional pension payments or benefits. More information is available from the complementary pension scheme of the deceased.

Pensions and social security:

The following are entitled to a survivor’s pension: the surviving spouse or a divorced spouse who has not remarried, orphans and, in the absence of a surviving spouse, lineal relatives by blood or marriage, collateral relatives up to the second degree and in certain cases children adopted as minors, private workers, trainees and employees hired to work in Luxembourg for somebody else in exchange for payment.

The deceased policyholder must have been insured for a minimum of 12 months in the three years prior to his or her death if death occurs during the coverage period following an occupational disease or an accident of any other kind.

The surviving spouse must have been married to the deceased for at least one year prior to the death of the insurance holder or prior to their retirement on the grounds of old age or invalidity. The marriage must not have been concluded with an old age or invalidity pension recipient.

If the aforementioned conditions are not met beneficiaries may still be entitled to a survivor’s pension in the case of the following:

- Death is caused by an accident occurring after the marriage,

- A child was born from that marriage,

- The marriage lasted for more than a year and the age gap between spouses is less than fifteen years,

- The marriage lasted for at least ten years

The survivor’s pension for spouses consists of:

- 100% of the lump-sum and special lump-sum payments the insurance holder is or would have been entitled to,

- 75% of the proportional increment and special proportional increment the insurance holder is or would have been entitled to.

In case the surviving spouse remarries the pension benefits are bought back in the following manner: sixty monthly payments if the surviving spouse remarries before the age of fifty and thirty-six monthly payments if the surviving spouse remarries after the age of fifty. The proportional increment is not bought back.

The orphan’s/father or mother’s pension consists of:

- one third of the special lump-sum payments the insurance holder is or would have been entitled to,

- 25% of the special proportional increment the insurance holder is or would have been entitled to

The pension is doubled for orphans who have lost both parents.

Pension benefits for orphans are paid until the age of 18 or until the age of 27 if the recipient is studying. The orphan’s pension is paid indefinitely if the orphan is unable to make a living for reasons of mental or physical disability. The orphan’s pension benefits stop when the orphan marries, unless they keep studying.

The total of pension benefits paid cannot exceed the amount the deceased would have been entitled to or was receiving when death occurred.

As regards health insurance and funeral funds the following applies:

In order to receive death benefits you are required to arrange for the funeral directors invoice to be settled by the bank or employer and to subsequently submit the original receipt to the health insurance fund of the deceased. The funeral directors invoice may be settled using funds from the current account of the deceased if sufficient funds are available on the legal basis that expenditure relates to the deceased themselves.

The amounts paid as ‘death benefits’ are indexed to the cost of living and were set at 130€ index 100. On 1st July 2010 the index was set at 719,84 points and payments therefore amount to 935,80€.

The amounts paid as ‘death benefits’ to newborn babies were set at 26,00€ index 100. The payments made depend on the fund and the contribution period.

If the deceased is a worker or a family member of a worker a lump-sum funeral allowance is paid to the person bearing the funeral costs upon submission of a receipted invoice and the death certificate. The funeral allowance is halved for children under the age of six and reduced by four fifths for stillbirths.

In order to receive pension benefits it is necessary to file an application with the Luxembourg body for insurance and pension services or with the body for insurance and pension services in the beneficiary’s country of residence. The mandatory supporting documents are listed on the application form.

In Luxembourg

- National Health Fund (‘Caisse Nationale de Santé’ (CNS))

- Insurance companies

The deceased may have taken out a life insurance policy or a death/funeral plan before his or her death with benefits for heirs.

Complementary mutual funds may also pay a number of benefits.

If the deceased was renting his or her home the rental agreement must be terminated and depending on the terms of use of the property three months notice must be given.

If the deceased was renting out a property which he or she owned the new contact and bank details of the person to whom rent is to be paid must be communicated to the tenants.

They must be informed of the death.

In case the deceased was the guardian of a person placed under his or her guardianship or of their children.

ALL THE OTHER FORMALITIES

Inform the tax authority in case of death.

A notary may be put in charge of succession-related procedures although this is not mandatory.

Make sure home, car and other insurance companies, financial institutions and other providers or suppliers are informed of the death of the deceased.

Any heir or legatee is required to submit a declaration of succession to the ‘Administration de l’Enregistrement et des Domaines’ (registration and domain administration) within a statutory deadline, generally six months after the death of the deceased.

Converting a joint account into a personal account.

Register the death at the social security.

In case the spouse keeps the vehicle provided no heir is opposed.

In the event of a death in the family – spouse or relative by blood or marriage – employees are entitled to three days’ leave (this also applies to civil partners). In the event of a death of a second-degree relative by blood or marriage employees are entitled to one day of bereavement leave. (Beware: bereavement leave cannot be carried over and must be taken immediately after the death has occurred.)

We are free to decide what will happen to our possessions after we die, except for the part reserved to our statutory heirs (reserved portion regime). A will must be drafted for this purpose.

The three main reasons for drawing up a will are as follows:

- To change the succession in line with legislative rules and requirements,

- To determine who gets what (e.g. to prevent inheritance disputes),

- To ensure your legal partner will inherit (partners not married but bound by civil partnership agreement).

There are two kinds of wills:

- The holographic will: handwritten, signed and dated, submitted or not to a notary, submitted or not to the ’Administration de l’Enregistrement et des Domaines’ Unit 3: Registration of Last Wills,

- The notarial/authentic will: the notary drafts the will based on what you dictate; the document is then signed and remains with the notary.

It is highly recommended that you consult a notary before drafting your will with a view to avoiding imprecise and misleading wording and ensuring the will complies with binding legal requirements.

It is also recommended that the notary store your will. The notary will submit the document to the president of the court in charge of the reading of the will after death. A notarial will is the safest option because problems, misunderstandings or the risk of someone challenging the authenticity of the will can be avoided.

A will can be revoked at any moment. Only the most recent will shall be taken into account unless its provisions are compatible with previous versions of the will. A notarial will cannot be revoked and replaced by a holographic one. Bear in mind that circumstances may change and take possible future scenarios into account when drafting your will.

Heirs and legatees of the estate are required to hand in a statement in writing to the local inheritance tax administration of the Luxembourg municipality where the deceased used to reside before his or her death.

Please refer to the relevant pieces of legislation on Gifts Inter Vivos and wills and testaments for more information.

Zum Schutz Ihrer Angehörigen im Todesfall können Sie mit einer Versicherungsgesellschaft den Abschluss einer Todesfallversicherung in Betracht ziehen.

In order to protect their family in case of death some people choose to take out death insurance with an insurance company.

It comes in two versions:

- Temporary contracts allowing the insurance holder to have a certain amount covered for a certain time period, which cannot be changed during the contract period. If the insurance holder during in that period, the money is transferred to a beneficiary (e.g. to provide a spouse with means in addition to statutory pension benefits),

- Temporary insurance of the outstanding balance covers a medium or long-term loan in case of death of the policyholder during the contract period. The beneficiary is usually a lender or a bank (e.g. to secure a loan in order to protect the family estate when a significant amount is needed to build or purchase property).